Incymo AI's Seed Round Deck that Raised $850k

Incymo.AI’s deck probably wouldn’t pass muster with investors — here’s why.

Background

- Company: Incymo, founded in 2021, is building products to maximize revenue in free-to-play video games with AI.

- Problem: Ideation and execution of performant video game ad creatives is complex.

- Solution: Incymo’s solution leverages AI to maximize advertising revenue in video games.

- Most Recent Funding: $850k seed round on February 16, 2023

- Total Funding: $850k

- Notable Investors: None

Bottom Line

Investors only get a few minutes to look over a deck and decide if it fits their investment thesis. Incymo.AI’s deck probably wouldn’t pass muster with investors — here’s why:

- The messaging throughout the deck is unclear and feels off. This is evident in the problem statement: “It hurts 10/10 to find the right idea to create performing ad creatives.”

- The gist is there, but at first glance the statement is confusing. A better problem statement would be: “The process of creating high-performing in-game advertisements is complex.”

- The ask slide creates another confusing statement: “$300k in investments to reach the KPI from a16z and close round A in 2023.”

- The statement leads to more questions than answers. Has a16z already invested and the $300k is a bridge to meet a KPI? Or has a16z set a contingency to invest based on an unmet KPI?

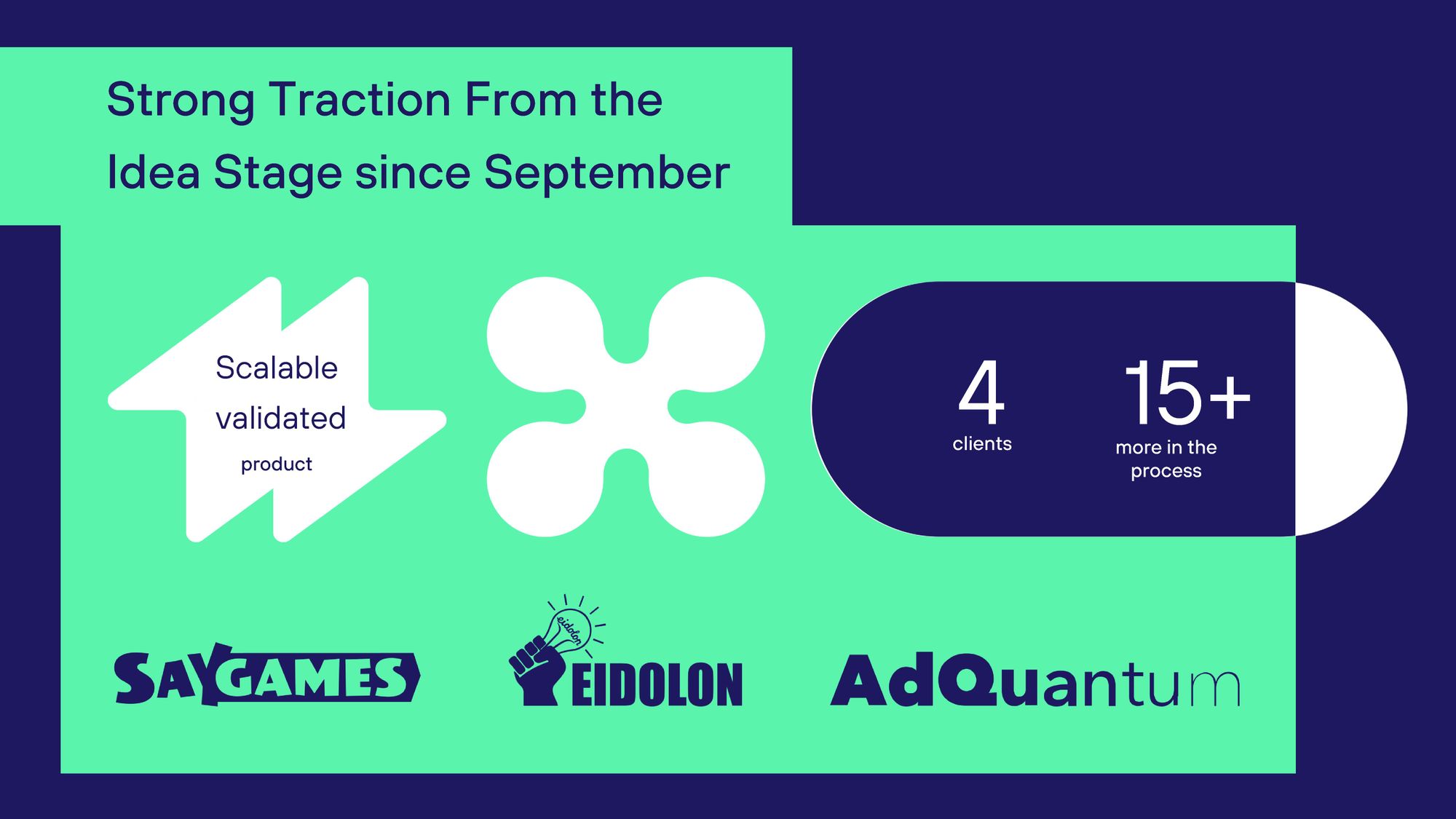

- Another point from the product traction slide: “15+ more [clients] in the process”. Without understanding where these clients are in the sales process or the company’s flywheel, they might never convert.

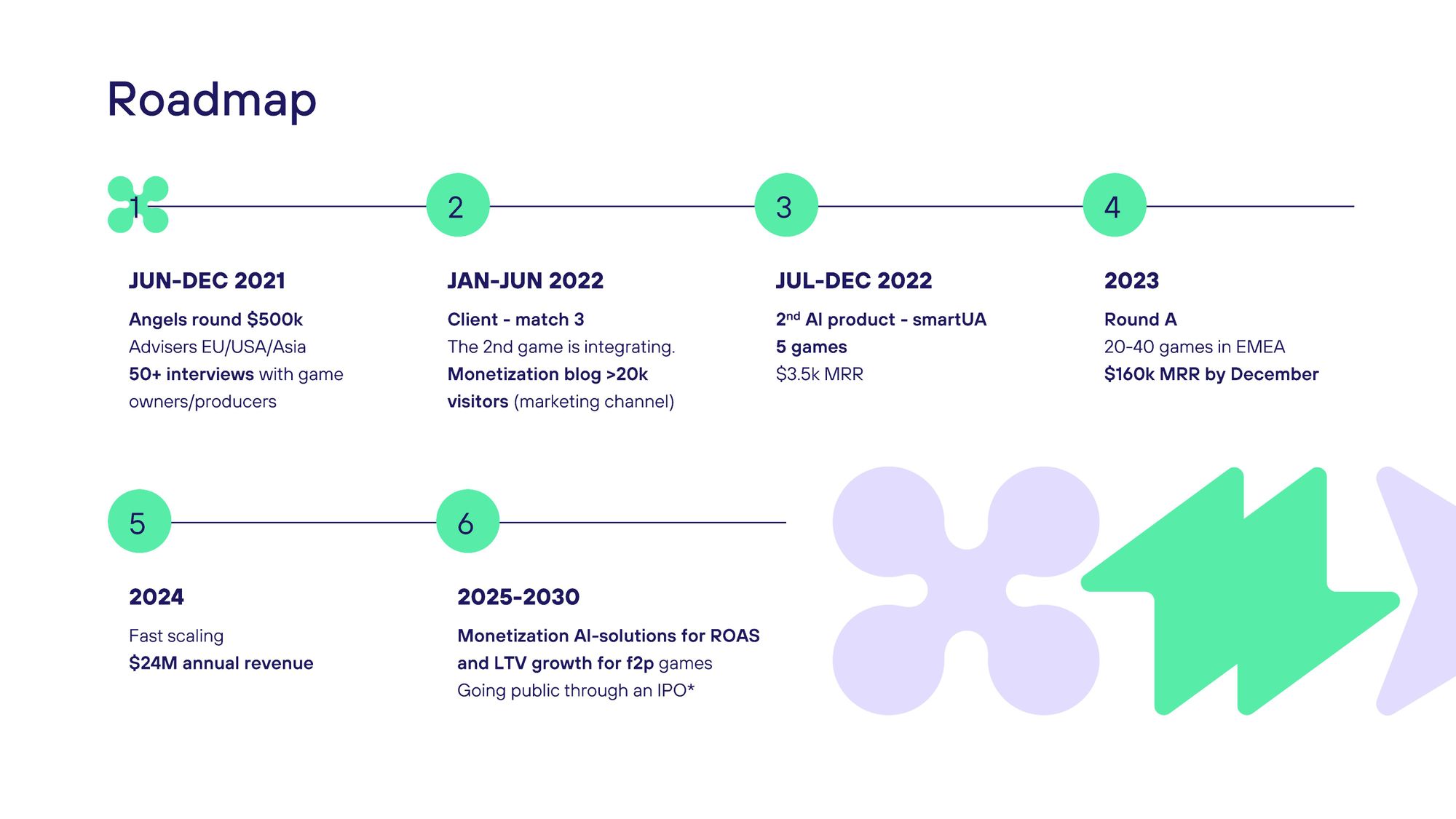

- Finally, the roadmap slide and other slides throughout the deck use too many vanity metrics. From the roadmap slide:

- “50+ interview is game owners/producers” isn’t a metric worth keeping track of and doesn’t give confidence on traction or if these interviews have produced anything valuable.

Sure, a pitch deck can't completely stand on its own, but the company should receive credit for achieving product-market fit, gaining traction, and generating revenue. Unfortunately, the deck falls short of creating a cohesive narrative around these points.

The Deck

Cover

Problem

Solution

Product Traction

Company Traction

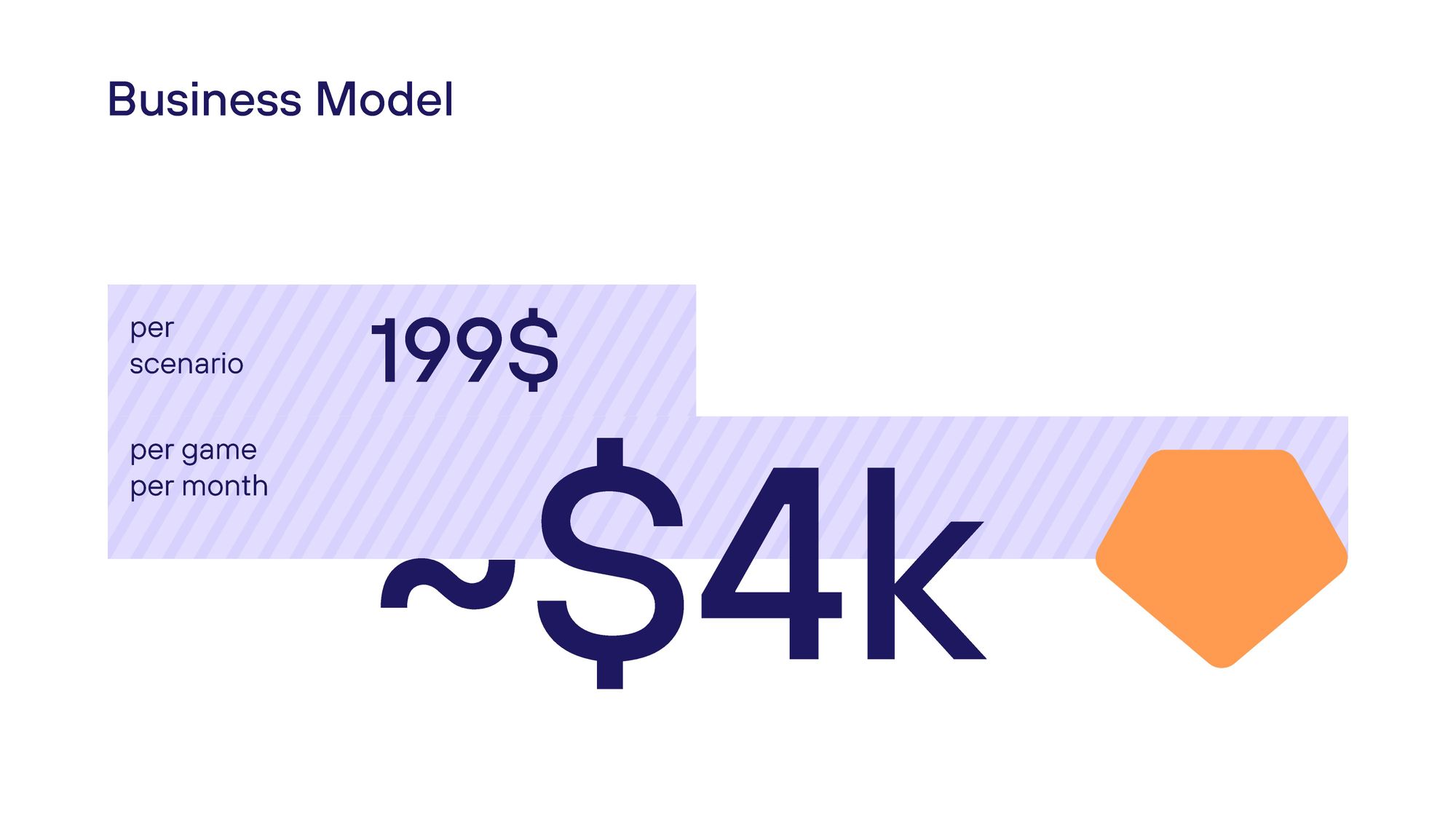

Business Model

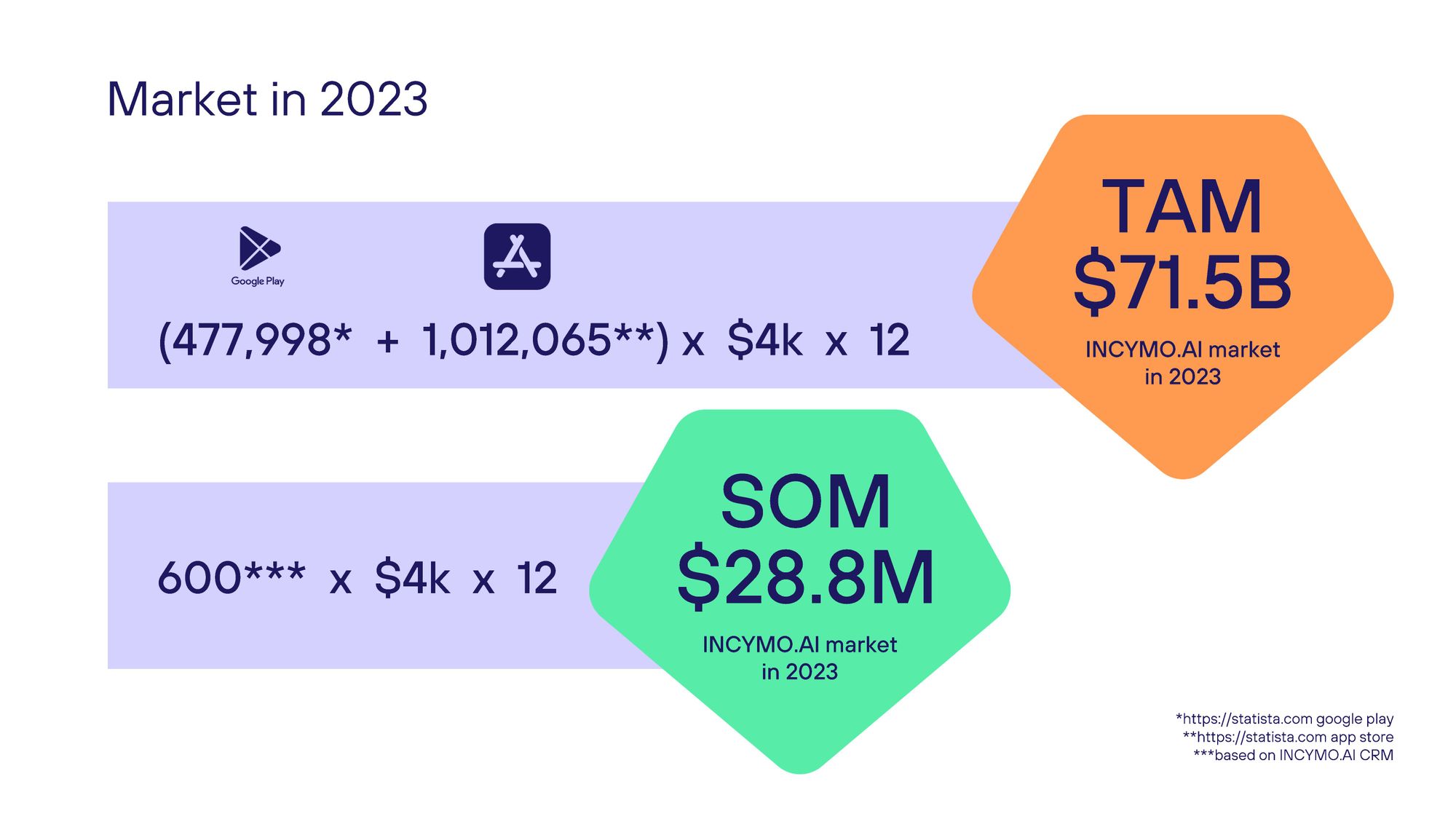

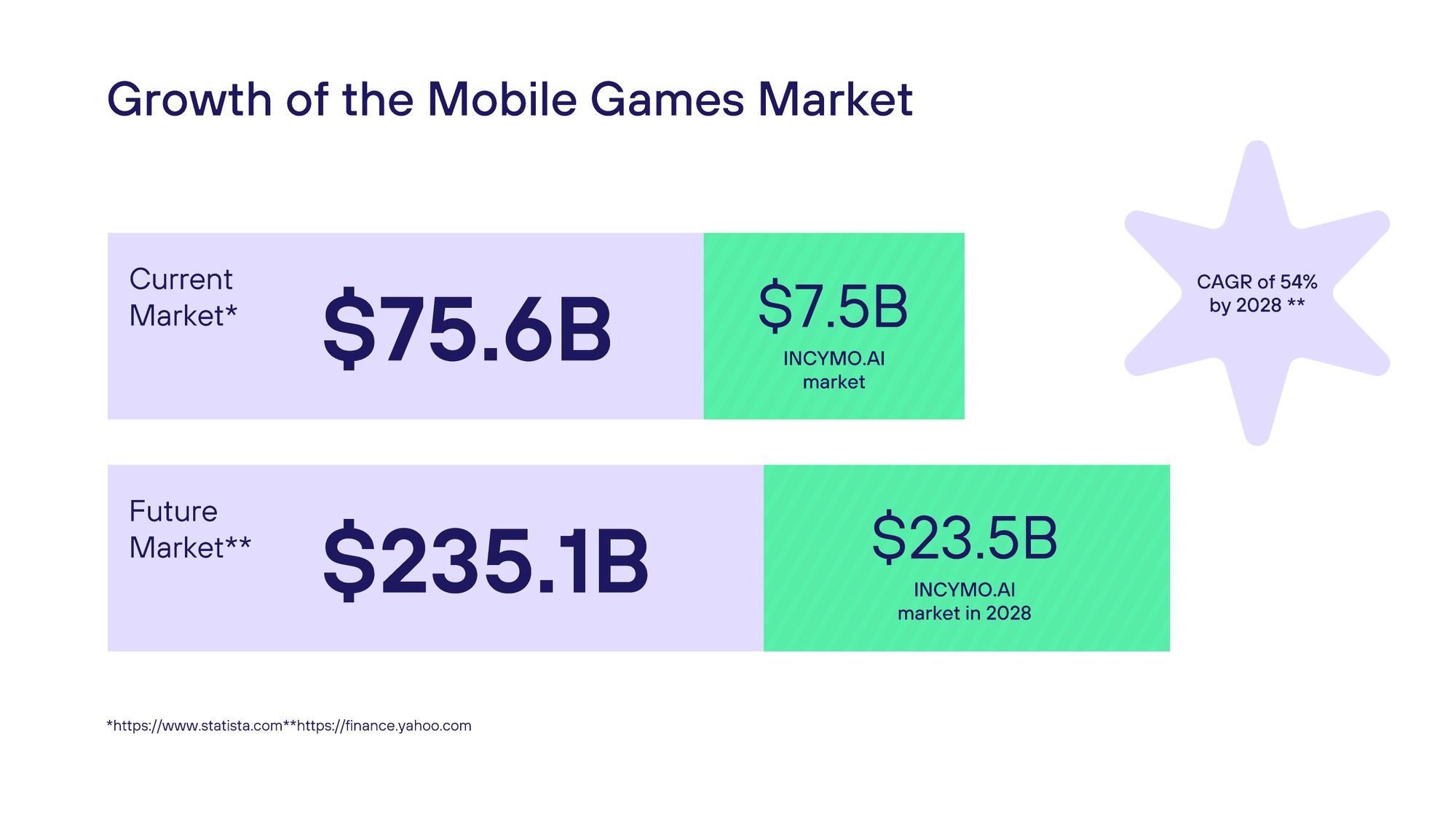

Market

Market Cont.

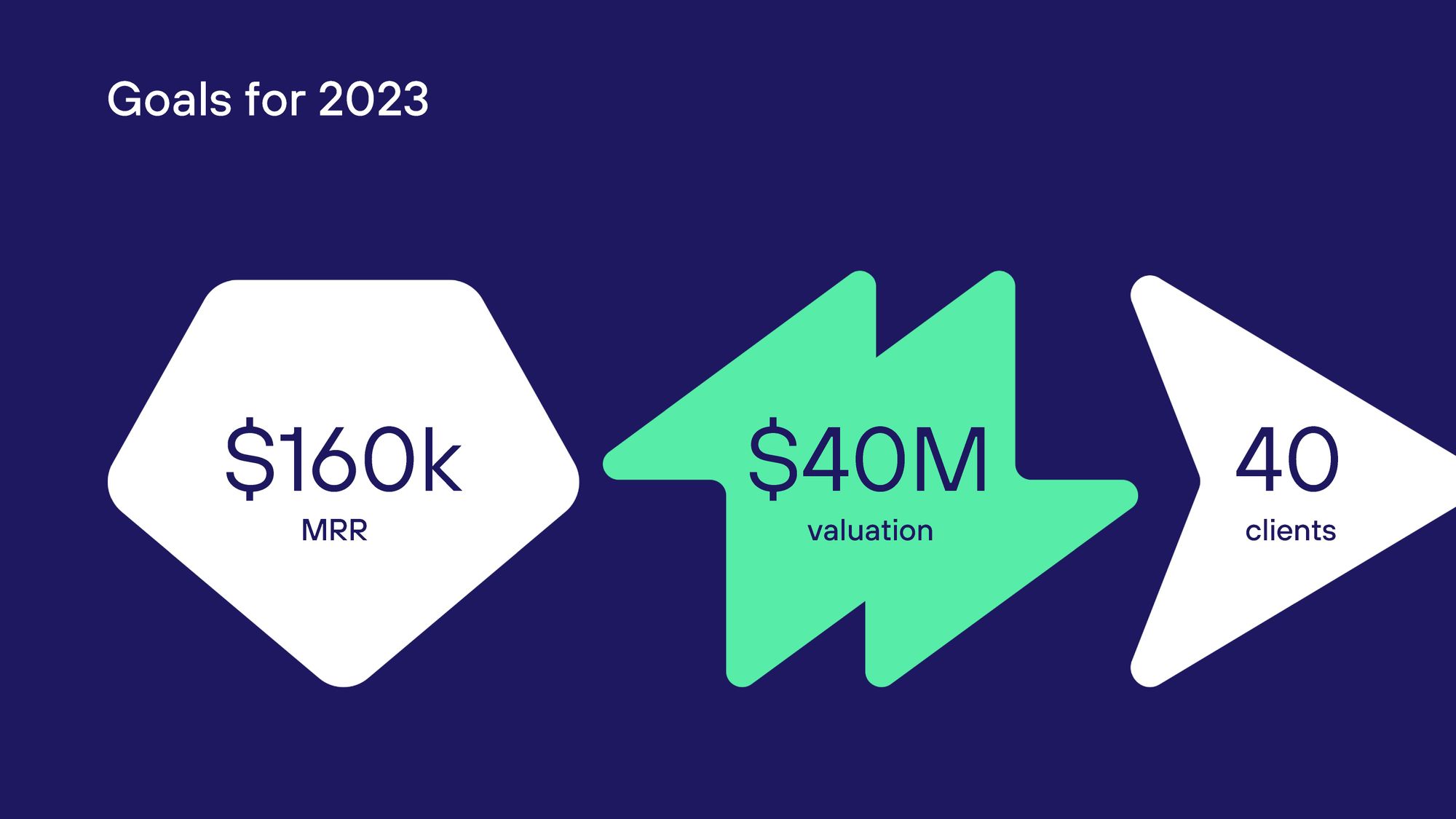

Company Goals

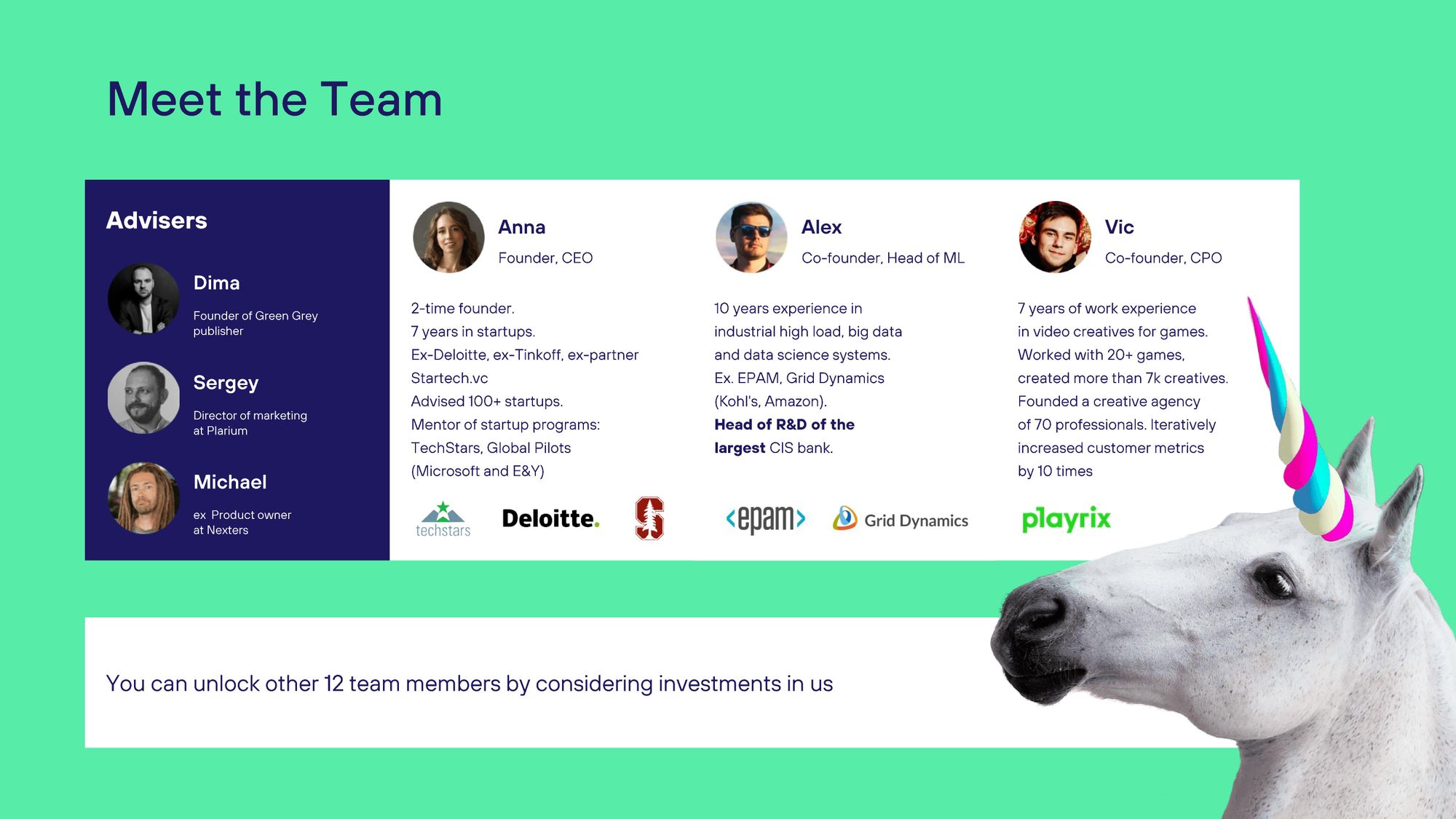

Team

Ask

Roadmap